rhode island tax table

1 The employees wages are subject to federal income tax withholding and 2 Any part of the wages were for services performed in Rhode Island. Rhode Islands 2022 income tax ranges from 375 to 599.

State Corporate Income Tax Rates And Brackets Tax Foundation

Directions Google Maps.

. The state sales tax rate in Rhode Island is 7 but you can customize this table as. The Rhode Island Tax Rate. Tax year 2019 data as of August 3 2020.

The Rhode Island tax rate is unchanged from last year however the income tax brackets increased due to the annual. 62550 142150 CAUTION. This page has the latest Rhode.

2022 Rhode Island Sales Tax Table. Multiply the adjusted gross biweekly wages times 26 to obtain the gross annual wages. 1 Executive Order 20-41 which was renewed by Executive Order 20-60 and Regulation 216-RICR-50-15-7 Safe Activities By.

A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount. However if Annual wages are more than 227050 Exemption is 0. RHODE ISLAND TAX COMPUTATION WORKSHEET RHODE ISLAND TAX RATE SCHEDULE 2018 TAX RATES APPLICABLE TO ALL FILING STATUS TYPES Taxable Income line 7 Over 0 62550 142150 But not over Pay--of the amount over 234563 612663 375 475 599 on excess 0 62550 142150.

And tax preparers the Rhode Island tax-filing season will begin on the same date. One Capitol Hill Providence RI 02908. The Rhode Island state tax tables listed below contain relevent tax rates and thresholds that apply to Rhode Island salary calculations and are used in the Rhode Island salary calculators published on iCalculator.

Divide the annual Rhode Island tax withholding by 26 to obtain the. A Rhode Island employer must with-hold Rhode Island income tax from the wages of an employee if. Instead if your taxable income is less than 100000 use the Rhode Island Tax Table located on pages T-2 through.

Rhode Island Income Tax Rate 2020 - 2021. 2022 Rhode Island Sales Tax Table. Multiply the adjusted gross biweekly wages times 26 to obtain the gross annual wages.

Rhode Island Division of Taxation. The Rhode Island income tax rate for tax year 2021 is progressive from a low of 375 to a high of 599. EMPLOYEES FROM WHOSE WAGES RHODE ISLAND TAXES MUST BE WITHHELD.

Apply the taxable income computed in step 5 to the following table to determine the annual Rhode Island tax withholding. Rhode Island state income tax rate table for the 2020 - 2021 filing season has three income tax brackets with RI tax rates of 375 475 and 599 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses. Apply the taxable income computed in step 5 to the following table to determine the annual Rhode Island tax withholding.

5 rows How to Calculate 2021 Rhode Island State Income Tax by Using State Income Tax Table. It kicks in for estates worth more than 1648611. Printable Rhode Island state tax forms for the 2021 tax year will be based on income earned between January 1 2021 through December 31 2021.

Thus on February 12 2021 the Rhode Island Division of Taxation will officially begin accepting and processing electronically filed personal income tax returns as well as paper returns on Form RI-1040 and Form RI-1040NR2. The top rate for the Rhode Island estate tax is 16. To receive free tax news updates send an e-mail with SUBSCRIBE in subject line.

The Rhode Island income tax has three tax brackets with a maximum marginal income tax of. The state sales tax rate in Rhode Island is 7 but. However if Annual wages are more than 231500 Exemption is 0.

Subscribe for tax news. Apply the taxable income computed in step 5 to the following table to determine the annual Rhode Island tax withholding. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount.

Table shows data for Rhode Island personal income tax refunds. Ad Register and Subscribe Now to work on your RI DoT Form RI-1040NR more fillable forms. The Rhode Island state tax tables are provided here for your reference.

TY means tax year. If you live in Rhode Island and are thinking about estate planning this guide has the information you need to get started but professional help in the form of a financial advisor can help you whether your planning an estate or dealing with any other financial. The Rhode Island tax rate is unchanged from last year however the.

Exemption Allowance 1000 x Number of Exemptions. Some amounts are rounded. 3 rows The Rhode Island tax tables here contain the various elements that are used in the Rhode.

Tax year 2018 data as of August 3 2019. The state income tax table can be found inside the Rhode Island 1040 instructions booklet. 2022 Rhode Island State Tax Tables.

5 rows We last updated Rhode Island Tax Tables in January 2022 from the Rhode Island Division of.

Rhode Island Income Tax Brackets 2020

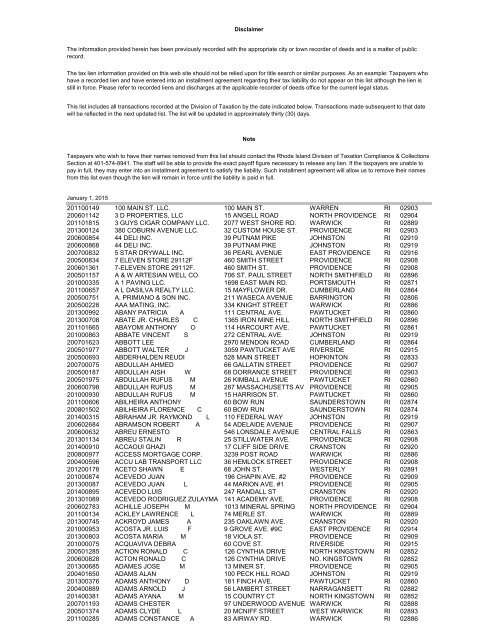

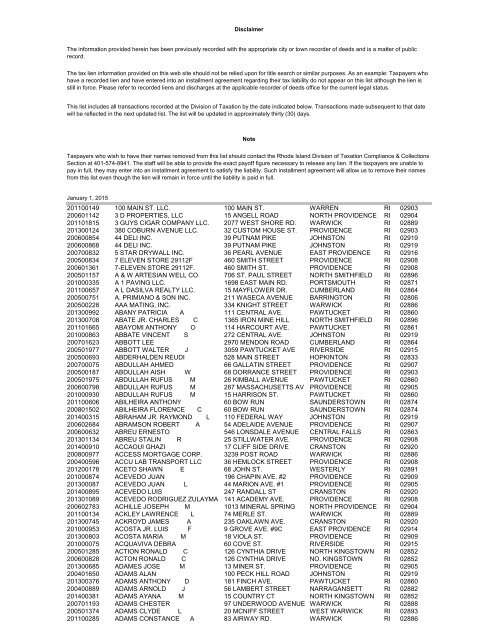

Download The Tax Lien List Pdf Document Rhode Island Division

Rhode Island Income Tax Ri State Tax Calculator Community Tax

Rhode Island Sales Tax Small Business Guide Truic

Rhode Island Income Tax Ri State Tax Calculator Community Tax

Rhode Island Income Tax Ri State Tax Calculator Community Tax

Rhode Island State Tax Tables 2022 Us Icalculator

Rhode Island Tax Forms And Instructions For 2021 Form Ri 1040

Historical Rhode Island Tax Policy Information Ballotpedia

Solved I M Being Asked For Prior Year Rhode Island Tax

Fairness Matters A Chart Book On Who Pays State And Local Taxes Itep

Where S My Rhode Island State Tax Refund Taxact Blog

Individual Income Tax Structures In Selected States The Civic Federation

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation