what is fsa health care 2022

Dependent Care Flexible Spending Account FSA. A flexible spending account FSA is offered through many employer benefit plans and allows you to set aside pretax money for eligible health.

You can use the money in your FSA to pay for many healthcare expenses that you incur such as insurance deductibles medical devices certain prescription drugs doctors office co-pays and more.

. Health Care Flexible Spending Accounts. These payment options are fully automated. When the card is used funds will be pulled directly from your Day Care FSA and are paid to the provider.

The most you can contribute pre-tax to your account is 2750 in 2021 which is unchanged from 2020. The Annual Open Enrollment Period for Plan Year 2022 will be October 12 2021 to November 19 2021. The promotional codes OPTFSA7 and OPTHSA5 offered by the Optum Store is intended for the sole use by Optum Bank flexible spending arrangement FSA and health saving account HSA members when making a purchase with their FSA or HSA.

Log into your WageWorks account on either the web portal or the mobile app select your preferred payment option and follow the prompts. In 2021 to a plan year ending in 2022. Health Care Flexible Spending Accounts FSAs let employees set aside money from their paycheck before taxes to use for certain eligible expenses.

The Consolidated Appropriations Act CAA 2021 temporarily allows for an eligible employee to be reimbursed expenses for dependents through age 13 ie dependents who have not yet turned 14 for the 2020 plan yearTo qualify for this relief you must have been enrolled on or before January 31 2020 and you must have unused amounts from the 2020 plan. Health Care FSA. The Health Care Flexible Spending Account HCFSA Program is a way to pay for eligible.

What is a Dependent Care FSA. Childrens Health Insurance Program CHIP keeps health care affordable for families Helping Apple Health Medicaid clients when they need it most. 2022 Health Program Guide An in-depth PDF brochure detailing Universitys Health Care Plan Prescription Drug Plan Dental Plans FSA HSA Personal Health Management and Well-U benefits.

A health FSA may extend the grace period for using unused benefits for a plan year ending in 2020 or 2021 to 12 months after the end of the plan year. WageWorks makes it easy for you to get reimbursed for eligible dependent care expenses using your WageWorks Dependent Care Flexible Spending Account FSA. Dependent-care Flexible Spending Accounts FSA let employees use tax-exempt funds to pay for childcare expenses they incur while at work.

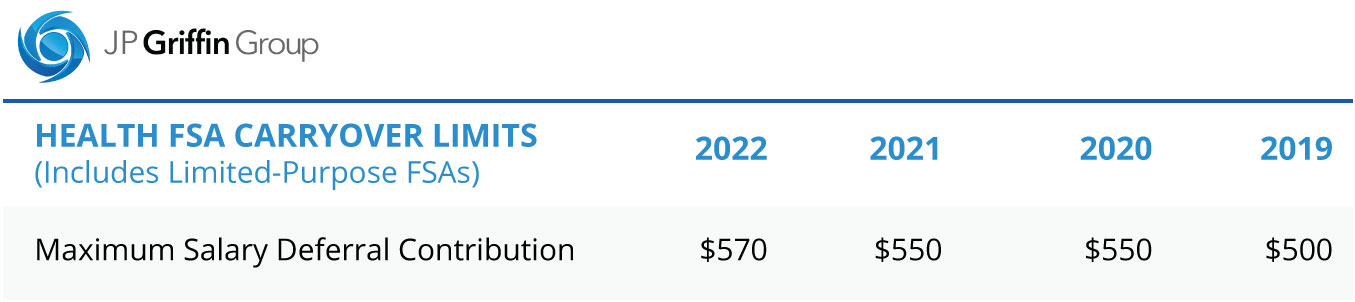

Check your plan for specific coverage details. The 2022 limits as compared to the 2021 limits are outlined below. HEALTH CARE FSA LIMITED PURPOSE FSA Dental and Vision Only Plans C or N wHSA DEPENDENT CARE.

Dependent Care Assistance. Family Maximum 10500 - for 2021 5000 - for 2022. These funds can be used to pay for eligible expenses.

Medical plan basics Review the medical plan basics with. The IRS has announced the new health savings account limits for 2022. Save money with a limited purpose FSA when paying for dental and vision costs.

You can use a Healthcare FSA for eligible medical dental vision feminine products over-the-counter and prescription drugs. Employees in 2022 can put up to 2850 into their health care flexible spending accounts health FSAs pretax through payroll deduction the IRS has announced. The Navia Benefits Card will only load the amount contributed so far to your Day Care FSA.

The Navia Benefits Debit MasterCard. The IRS has announced the new health savings account limits for 2022. Your FSA plan may exclude reimbursement for certain categories of items.

711 Monday through Friday 7 AM to 7 PM CT Saturday 9 AM to 2 PM CT 2022 PayFlex. Next year individuals can set aside 3650 in tax-free funds. The Flexible Spending Accounts FSA Program EnrollmentChange Form will be available in early October.

But the late announcement left. Among other things the notice indicates that employee contribution limits toward health flexible spending accounts and qualified transportation fringe benefits will increase slightly for 2022. Its an easy way to save money while enjoying the benefits of having an in-home.

HSA Flexible Spending Account FSA and Health Reimbursement Arrangement HRA participants access to 20K additional eligible products including. On November 10 2021 the IRS released Revenue Procedure 2021-45 which contains the 2022 limits for health flexible spending accounts FSAs and commuter and parking benefits among other limits. The deadline to submit your dependent care expenses against your 2021 Plan Year is April 30 2022.

A Dependent Care FSA sometimes called a Dependent Care Assistance Plan or DCAP is a pre-tax benefit account offered by your employer and used to pay for qualified out-of-pocket dependent care expenses like your nannys wages. A health FSA may allow an individual who ceases participation in a health FSA during calendar year 2020 or 2021 to continue to receive reimbursements. Flexible Spending Account Health Reimbursement Arrangement and other Optum Financial accounts.

How do I access my Day Care FSA. A Healthcare Flexible Spending Account FSA is a personal expense account that works with your employers health plan allowing you to set aside a portion of your salary pre-tax to pay for qualified medical expenses. A Health Flexible Spending Account also known as an FSA is a type of pre-tax benefit where you receive significant savings on medical dental and vision expenses for you and your eligible dependents.

Plan Year 2022 Annual Open Enrollment Period. In Revenue Procedure 2021-45 the Internal Revenue Service sets forth a variety of 2022 adjusted tax limits. Our HSAs FSAs HRAs and consumer directed health care platform is the solution of choice for employers health plans and banks.

Hsa Vs Fsa What S The Difference Quick Reference Chart

A Quick Guide To Flexible Spending Accounts Accounting Health Savings Account Flexibility

Zyrtec 10mg 65 Liquid Gelsdefault Title In 2022 Zyrtec Gel Liquid

Hipaa Compliance Checklist Guide 2020 What Is Hipaa Compliance Hipaa Compliance Health Information Management Healthcare Compliance

Explore Our Example Of Blank Spreadsheet Household Budget Template For Free In 2022 Budget Spreadsheet Template Budget Spreadsheet Budget Planner Template

Pin By Muqaddas Arefi On Sports In 2022 Incoming Call Screenshot Incoming Call Health

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Using Your Fsa Or Hsa To Pay For Massage Therapy Zeel Massage Therapy Massage Therapy

:max_bytes(150000):strip_icc()/dotdash-hsa-vs-fsa-v3-66871b956baa4be786d2138777e70067.jpg)

Health Savings Vs Flexible Spending Account What S The Difference

Foot Circulation Plus Fsa Or Hsa Eligible Medic Massager Clear Ebay Foot Massager Machine Electric Muscle Stimulator Massage Machine

Healthcare Fsa Vs Hsa Understanding The Differences Forbes Advisor

Otc Card Eligible Items At Walmart Dear Adam Smith In 2022 Health Savings Account Prepaid Credit Card Walmart

What Is An Fsa Definition Eligible Expenses More

How Emr Technology Connects Doctors With Patients Https Tinyurl Com W3l3cmh Socialbookmarking Seo Backlinks Onlinemarketing I Dental Kids Emr Medical

Comparison Of Health Savings Accounts Hsas Flexible Spending Accounts Fsas And Health Reimbursement Arrangements Health Savings Account Accounting Savings

We Offer Individual Health Insurance Family Floater Health Cover Extended Health Insurance And Wome Best Health Insurance Infographic Health Health Insurance

Best Deals And Coupons For Lenscrafters Lenscrafters Sale Design Sunglasses Branding